Overview

In Unit 1 you have seen what a marketing plan must contain.

This Unit is aimed at giving you more instruments to collect the necessary information.

Here you can get information on how to analyze your market and your competitive environment, deepening the important concept of benchmarking.

We’ll speak of desk and field analysis and help you, with a few questions, complete your SWOT analysis.

Desk analysis

| What | Where | How |

| All main data and their interpretation |

The first source to consider is Farmers’ Associations. They usually make a summary of the most relevant data for a business, and offer a good interpretation of it Copa-Cogecas website gives a useful summary of farmers associations in Europe: www.copa-cogeca.eu. At italian level, the most important association is: www.coldiretti.it |

Read newsletters, and print, or copy, the most relevant news. You can have a small database to use in case of «marketing plan». Of course, data has to be updated, but some trends take months to change. As a general rule, data must not be older than 6 months. You can prepare different folders with different titles |

| Macro-economic data concerning the area you are interested in. GDP trend, per – capita GDP, income inequality, per capita consumption of different types of food, prices. |

For national and local data, you can visit the website of the National Statistical office or of the Chamber of Commerce. The Chamber of Commerce is also a good source of data on foreign countries. Other good sources of international data are : www.oecd.org, www.imf.org/external/data.htm, www.countrystat.org, data.worldbank.org, datatopics.worldbank.org/consumption/, databank.worldbank.org/data/home.aspx |

Learn how data is selected and downloaded in each site and write a few notes, so that you do not forget. Select and download always the same tables, so that you’ll get used to it and end up becoming expert and quick. Focus your attention on a few elements. Is GDP growing? This is good. Is it decreasing? In this case, most consumers will prefer low price products (even if there are always segments who do not «feel» the crisis). Is per-capita GDP higher or lower than in you country / area? The comparison of per capita GDP levels are a proxy which tells you if the population of an area has, on average, a higher or lower income. Be careful to use: homogeneous data (that have been transposed into one currency, that are calculated in a similar way ...); PPP (purchasing power parity) data. Therefore, the definition you have to choose is «gross domestic product at purchasing power parity per capita”. PPP takes into account the fact that the same amount of money does not buy the same things in different countries, and standardizes data from this point of view. |

| Statistical offices often perform a regular survey on household expenditure. This is very useful to evaluate the composition of food consumption and to estimate the value of the market: how many families might buy your product? |

In this link you find a list of national statistical offices in Europe: epp.eurostat.ec.europa.eu/portal/page/portal/statistics/themes |

|

|

A good source of data is FFT, a society who sells report on food consumption in different areas: www.fft-international.com/index.php Other important companies selling reports on Agricultural trends and Fast Moving Consumer Goods (FMCG): www.euromonitor.com, www.nielsen.com/eu/en.html, www.datamonitor.com |

And here are the links for North America: | Income inequality lets you know if the average per capita GDP corresponds to many people with similar levels of income or some people with very high and some with very low income. For marketing, it is different to sell to very rich and very poor people, or to a large middle class |

| Consumer behaviour |

|

Read newsletters, and print, or copy, the most relevant news. You can have a small database to use in case of «marketing plan». Of course, data have to be updated, but some trends take months to change. As a general rule, data and studies must not be older than 6 months – 1 year. You can prepare different folders with different titles |

| Law and trade policies |

|

Read newsletters, and print, or copy, the most relevant news. You can have a small database to use in case of a «marketing plan». Of course, data has to be updated, but some trends take months to change. As a general rule, data and studies must not be older than 6 months – 1 year. You can prepare different folders with different titles |

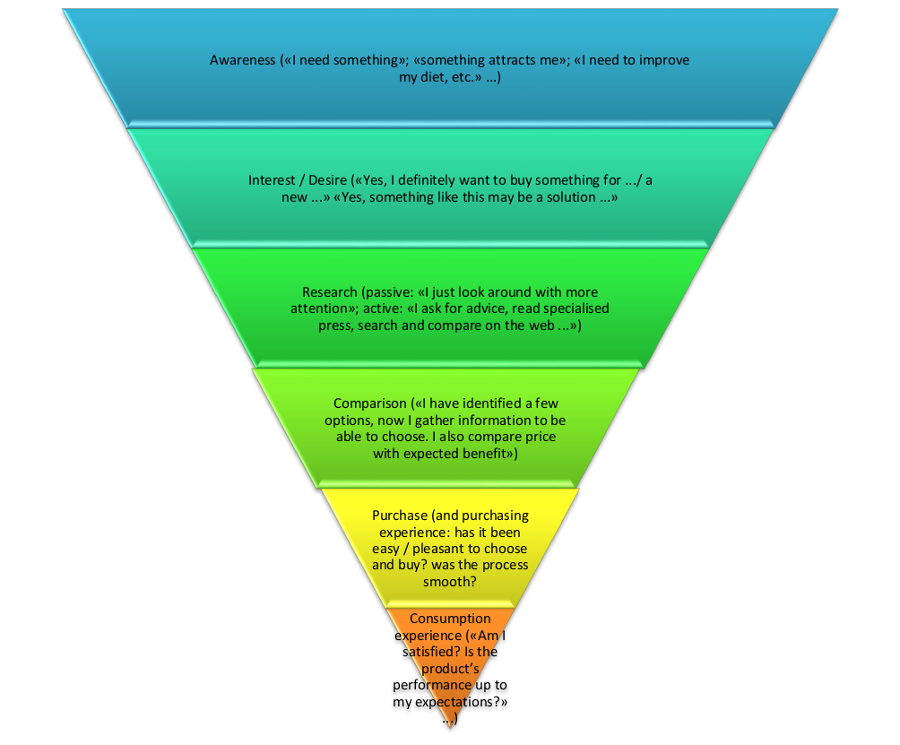

Purchasing process

Field analysis

| Why, on what purpose | What | How |

| 1) To identify a market space: are consumers completely satisfied with what they have, or may there be something new that can be offered to them? Is there something missing in the current range? |

|

a) Organise a meeting (2 hrs) with 8-10 consumers. To tempt them to participate, offer them a gadget, a voucher, etc.. Ask them to discuss the theme you are interested in. Start with the present situation («are you completely satisfied with ...?) and then go on with potentialities («what would you say if I offered you ...». Pay attention to let everyone speak, restrain exuberant participants a bit in order to leave space for the shy ones. b) - c) The same questions of focus groups can be asked to single consumers, also with the aim of exploring their degree of satisfaction and desires in detail. In this case, you have to pay particular attention when writing the questionnaire: be careful not to suggest answers. It is difficult, but you will receive a greater benefit from your work if you fully accept customers’ points of view, without trying to influence them, even if what they say shows their ignorance on the matter and seems to favour your competitor. d) a), b) and c) can be used to ask consumers to evaluate a current product, to see if they find something missing, and show a need for something different e) Store checks are a must for businessmen. The farmer who avoids doing store checks because he is too busy acts exactly as the man who laboriously waters with a broken bucket because he has no time to fix it (being too busy watering). Stores located in the target market have to be visited regularly, so that not only the current situation can be monitored, but also changes to it. Retailers have a knack to perceive market trends, so if a certain product is strongly present and promoted, there may be something in it. And what about products which always have cut-price promotions, as if the store wants to get rid of them, to make space for something else? Packaging has to be studied, its colours, its messages, possible innovations. Keen attention must be given to our competitor’s products. How are they positioned? The same goes for competitors who have their own stall. What do they offer, what do they NOT offer that should be offered instead? Can you take advantage of that? You can also add a bit of the so-called «mystery shopping»: buy something, ask questions, and pay attention to the way the seller presents the product: which features does he/she enhance? |

| 2) To assess a new idea, to see if the market will accept it with enthusiasm | Concept test | Write the «concept» of your idea, in no more than one page. What is it? Why is it «special»? What benefit can it offer? Add an image. And now show it to a number of clients and potential clients, and ask a few questions: Do you like it? How much do you like it, from 1 to 10? Do you think you would buy it? If you had to choose between this product and «product X» (competitor) which one would you choose? Why? How much would you pay for it (choose between options)? The test can be done by means of a focus group, personal interviews, but also quantitative interviews (a large number of interviews to a sample of consumers which, because of its size and composition, in representative of a certain population. |

| 3) To verify if the new product is exactly what consumers want (which you have designed on the basis of the concept) | Prepare a prototype of your product (which has to be as similar to the final version as possible), and a mock-up (a full size model) of its packaging. Show it to different kinds of consumers, let them try the product (the way they would use it at home), ask questions and accept their answers, using their feedback in your feasibility analysis. You can use the same methods of the concept test, but in this case consumers have to touch and taste the product. |

Quantitative field research tools

| PAPI | Paper And Pencil Interviewing. Data obtained from the interview is filled in on a paper form using a pencil. |

| CAPI | Computer Assisted Personal Interviewing. This method is very much similar to the PAPI method, but the data is directly entered into a computer programme instead of first using paper forms. |

| WAPI | Web Assisted Personal Interviewing. The respondents answer the questions online, but they are also assisted online in doing so. |

| CASI | Computer Assisted Self Interviewing. The CASI method involves respondents taking place behind the computer themselves in order to fill in the questionnaire. |

| CAWI | Computer Assisted Web Interviewing. Online research in which data is obtained electronically using online questionnaires. These questionnaires contain references so that the correct questions are asked to each respondent. |

| CATI | Computer Assisted Telephone Interviewing. The questions are usually presented to the interviewers on a computer screen, after which they ask them to the respondents. To ensure that the correct questions are asked to each respondent, the specialised computer software uses "skips": Certain answers can lead to the next question being different. This also prevents the respondent from having to answer irrelevant questions. |

| TAPI | Tablet Assisted Personal Interviewing. This method is virtually identical to the CAPI method, but the data is entered into a tablet instead of a computer/laptop. |

| TASI | Tablet Assisted Self Interviewing. This method is virtually identical to the CASI method, but the data is entered into a tablet instead of a computer/laptop. |

| SAPI & SASI | SAPI: Smartphone Assisted Personal Interviewing. With this method, the data is entered into a smartphone by the interviewer. SASI: Smartphone Assisted Self Interviewing. With this method, the data is entered into a smartphone by the respondent. |

Competitor benchmarking

It is very important that companies compare themselves to their competitors because ... that’s what clients do all the time, and the way they choose! What you have to do is 1) to identify your main competitors IN THE MARKET SEGMENT concerning your business and marketing plan 2) if there are too many, choose a few competitors who, because of their characteristics, mostly resemble the type which you feel are more dangerous. 3) Write a list of the features you want to examine. What do you have to compare? All characteristics that enter the competitive game in this specific case. Let’s see a few of them. And how can you get information? By observing, visiting stores, talking with clients ...

| Positioning | What is your competitors positioning in customers’ minds? Do they regard his product as high – end, medium level, discount level? And what is your positioning in comparison? |

| Benefit for consumers | Is your competitor’s product more or less effective and/or efficient in responding to customers’ needs? |

| Service |

What is his level of service? Pre and post-sale assistance? Delivery? Organisation? Administration? And yours? |

| Promotion |

Does your competitor promote his product adequately? How much do you estimate that he invests in communication? Which media does he choose? Is he communicating on social networks properly? How is his website? Is it nice, easy to navigate, updated, rich? What is the unique selling point he uses? How high is is brand awareness (which means that consumers recognize his brand and can say which values it is linked to)? And his reputation (is he «well known» because of ethics, quality, traceability, environment friendliness)? And what about you? |

| Competitive analysis | How does your competitor face competition? Has he achieved competitive advantages? Has he developed a bargaining power vis a vis suppliers? Have his clients become so loyal to his brand that it would be expensive – in terms of promotion and innovation – to make them change their mind? Is it difficult, for another company, to sell a similar product and attract clients just saying «me too»? Are high investments needed to enter the market segment where he is incumbent? |

| Price | What is your competitor’s price strategy? Is he a price taker or a price maker? Is he able to obtain a price premium, because of his perceived quality? How is his price compared to yours? Higher? Lower? Why? Do you think the difference is justified? |

| Cost structure | Are you able to find information about your competitor’s cost structure, to be compared with yours? Is his financial statement available? By comparing costs, you might discover that there are ways to reduce the incidence of particular costs ... |

| Performance | If the finance statement is available, you might compare margins and profits, and if it refers to different years, you can also compare trends ... |

SWOT analysis tool

Strengths

Weaknesses

Opportunities

Threats