Introduction

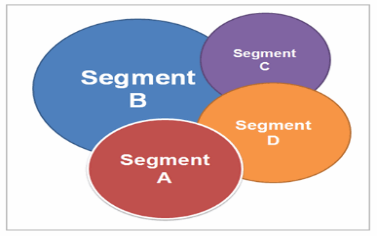

We often speak of “target clients”, “target consumers”, “target market segments”. But how is it possible to identify them? Which variables are necessary to consider, which reasoning has to be followed?

There isn’t a scientific method, but in this unit you can find some useful points to consider, examples of a reflection process that you can reproduce, adapting it to specific situations.

Let’s first of all consider the classification of criteria you have seen in Module I Unit 2 ...

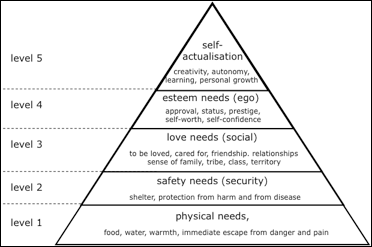

By reading specialised magazines and newsletters, and / or exploring dedicated websites, besides using our own common sense, we can associate each category to possible specific needs. While doing this, there can emerge the needs of further segmenting a category: for example, people over 65 years old can be divided into those who are perfectly fit, go to a gym, choose a healthy diet, etc., and those who are not so well, and need special services and medical treatment. This may depend on age, but mostly on lifestyles, so, if we are interested in this target, we’ll have to look for data that will help us assess how many of the first type there are and how many of the second type. Can this be related to their level of education? In this case, we shall use education as a proxy of the variable that we want to study.

On the next page, you can see a few hypotheses expressed, to be tested in practice. Of course, they are not valid in all cases, and have to be adapted to circumstances (city? countryside? Uk? China?, etc.)

Examples to consider

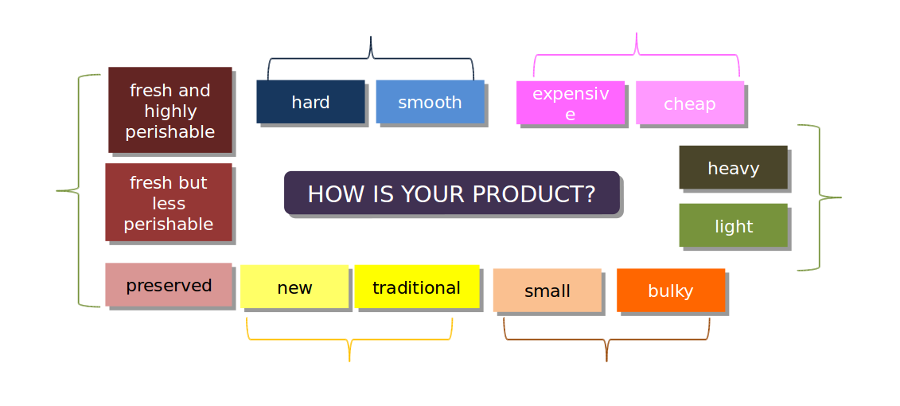

A possible mental path: From product features to market segments

How to use this page: product characteristics are linked to special needs, and these needs can be linked to special market segments / groups of clients. There is virtually no end to the possibilities that can be envisaged, but here you find an example of how to reflect.

You can apply this example to a product you would like to sell, to answer the questions: to whom? why? when? how?

Quantitative field research tools

| PAPI | Paper And Pencil Interviewing. Data obtained from the interview is filled in on a paper form using a pencil. |

| CAPI | Computer Assisted Personal Interviewing. This method is very much similar to the PAPI method, but the data is directly entered into a computer programme instead of first using paper forms. |

| WAPI | Web Assisted Personal Interviewing. The respondents answer the questions online, but they are also assisted online in doing so. |

| CASI | Computer Assisted Self Interviewing. The CASI method involves respondents taking place behind the computer themselves in order to fill in the questionnaire. |

| CAWI | Computer Assisted Web Interviewing. Online research in which data is obtained electronically using online questionnaires. These questionnaires contain references so that the correct questions are asked to each respondent. |

| CATI | Computer Assisted Telephone Interviewing. The questions are usually presented to the interviewers on a computer screen, after which they ask them to the respondents. To ensure that the correct questions are asked to each respondent, the specialised computer software uses "skips": Certain answers can lead to the next question being different. This also prevents the respondent from having to answer irrelevant questions. |

| TAPI | Tablet Assisted Personal Interviewing. This method is virtually identical to the CAPI method, but the data is entered into a tablet instead of a computer/laptop. |

| TASI | Tablet Assisted Self Interviewing. This method is virtually identical to the CASI method, but the data is entered into a tablet instead of a computer/laptop. |

| SAPI & SASI | SAPI: Smartphone Assisted Personal Interviewing. With this method, the data is entered into a smartphone by the interviewer. SASI: Smartphone Assisted Self Interviewing. With this method, the data is entered into a smartphone by the respondent. |

Competitor benchmarking

It is very important that companies compare themselves to their competitors because ... that’s what clients do all the time, and the way they choose! What you have to do is 1) to identify your main competitors IN THE MARKET SEGMENT concerning your business and marketing plan 2) if there are too many, choose a few competitors who, because of their characteristics, mostly resemble the type which you feel are more dangerous. 3) Write a list of the features you want to examine. What do you have to compare? All characteristics that enter the competitive game in this specific case. Let’s see a few of them. And how can you get information? By observing, visiting stores, talking with clients ...

| Positioning | What is your competitors positioning in customers’ minds? Do they regard his product as high – end, medium level, discount level? And what is your positioning in comparison? |

| Benefit for consumers | Is your competitor’s product more or less effective and/or efficient in responding to customers’ needs? |

| Service |

What is his level of service? Pre and post-sale assistance? Delivery? Organisation? Administration? And yours? |

| Promotion |

Does your competitor promote his product adequately? How much do you estimate that he invests in communication? Which media does he choose? Is he communicating on social networks properly? How is his website? Is it nice, easy to navigate, updated, rich? What is the unique selling point he uses? How high is is brand awareness (which means that consumers recognize his brand and can say which values it is linked to)? And his reputation (is he «well known» because of ethics, quality, traceability, environment friendliness)? And what about you? |

| Competitive analysis | How does your competitor face competition? Has he achieved competitive advantages? Has he developed a bargaining power vis a vis suppliers? Have his clients become so loyal to his brand that it would be expensive – in terms of promotion and innovation – to make them change their mind? Is it difficult, for another company, to sell a similar product and attract clients just saying «me too»? Are high investments needed to enter the market segment where he is incumbent? |

| Price | What is your competitor’s price strategy? Is he a price taker or a price maker? Is he able to obtain a price premium, because of his perceived quality? How is his price compared to yours? Higher? Lower? Why? Do you think the difference is justified? |

| Cost structure | Are you able to find information about your competitor’s cost structure, to be compared with yours? Is his financial statement available? By comparing costs, you might discover that there are ways to reduce the incidence of particular costs ... |

| Performance | If the finance statement is available, you might compare margins and profits, and if it refers to different years, you can also compare trends ... |

SWOT analysis tool

Strengths

Weaknesses

Opportunities

Threats