Introduzione

Si parla spesso di "clienti target", "target di consumatori", "segmenti di mercato obiettivo". Ma come è possibile identificarli? Quali variabili è necessario prendere in considerazione, che il ragionamento deve essere seguito?

Non c'è un metodo scientifico, ma in questa unità è possibile trovare alcune considerazioni utili, esempi di processi di riflessione che è possibile riprodurre, adattandoli a contesti specifici.

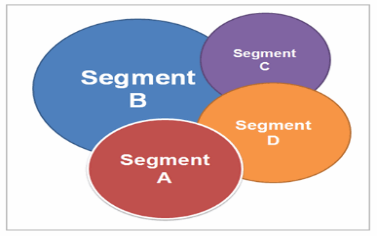

Riprendiamo prima di tutto in considerazione la classificazione dei criteri che abbiamo visto nel Modulo I Unità 2

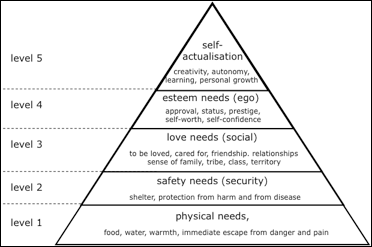

Con la lettura di riviste specializzate e newsletter, e / o l’esplorazione di siti web dedicati, oltre che con l’impiego del nostro buon senso, possiamo associare ad ogni categoria di eventuali clienti possibili esigenze specifiche. Nel fare questo, può emergere la necessità di segmentare ulteriormente una categoria: ad esempio, le persone con più di 65 anni possono essere suddivise in quelle che sono perfettamente in forma, vanno regolarmente in palestra, hanno scelto una dieta sana, ecc., e quelle che non sono così in forma, ed hanno bisogno di servizi speciali e cure mediche. Questo può dipendere dall'età, ma soprattutto dipende dagli stili di vita adottati, così, se a noi interessa un certo target, dovremo cercare i dati che ci aiuteranno a valutare il numero di soggetti del primo tipo ci sono e del secondo tipo. Può forse trattarsi di un dato correlato al livello di istruzione? In questo caso, useremo il livello di istruzione raggiunto come proxy della variabile che vogliamo studiare.

Nella pagina seguente, è possibile vedere alcune ipotesi espresse, da testare in pratica. Naturalmente le considerazioni non sono valide in tutti i casi, e devono essere adattate alle circostanze (città? Campagna? U.K.? Cina ? ecc.)

Esempi di possibili ragionamenti

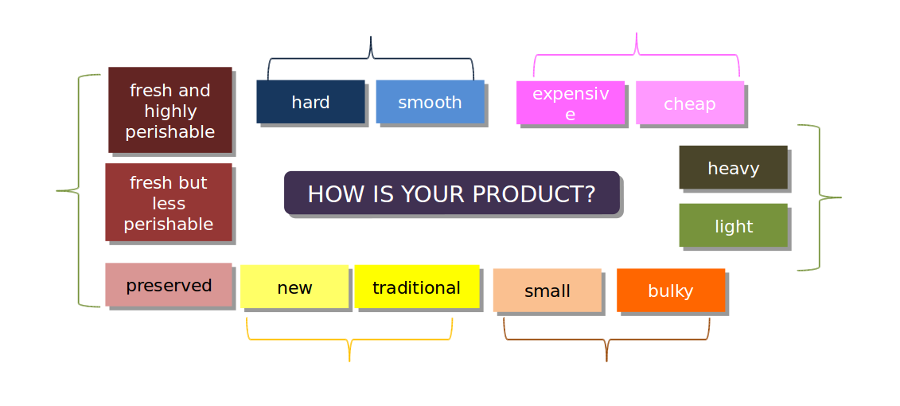

Un possibile percorso mentale: dalle caratteristiche del prodotto ai segmenti di mercato

Come usare questa pagina: le caratteristiche del prodotto sono legate a particolari esigenze, e queste esigenze possono essere collegate a particolari segmenti di mercato / gruppi di clienti. Non vi è praticamente fine alle possibilità che possono essere previste, ma qui si trova un esempio di un percorso di ragionamento.

È possibile applicare questo esempio a un prodotto che si desidera commercializzare, per rispondere alle domande: a chi? perché? quando? come?

Quantitative field research tools

| PAPI | Paper And Pencil Interviewing. Data obtained from the interview is filled in on a paper form using a pencil. |

| CAPI | Computer Assisted Personal Interviewing. This method is very much similar to the PAPI method, but the data is directly entered into a computer programme instead of first using paper forms. |

| WAPI | Web Assisted Personal Interviewing. The respondents answer the questions online, but they are also assisted online in doing so. |

| CASI | Computer Assisted Self Interviewing. The CASI method involves respondents taking place behind the computer themselves in order to fill in the questionnaire. |

| CAWI | Computer Assisted Web Interviewing. Online research in which data is obtained electronically using online questionnaires. These questionnaires contain references so that the correct questions are asked to each respondent. |

| CATI | Computer Assisted Telephone Interviewing. The questions are usually presented to the interviewers on a computer screen, after which they ask them to the respondents. To ensure that the correct questions are asked to each respondent, the specialised computer software uses "skips": Certain answers can lead to the next question being different. This also prevents the respondent from having to answer irrelevant questions. |

| TAPI | Tablet Assisted Personal Interviewing. This method is virtually identical to the CAPI method, but the data is entered into a tablet instead of a computer/laptop. |

| TASI | Tablet Assisted Self Interviewing. This method is virtually identical to the CASI method, but the data is entered into a tablet instead of a computer/laptop. |

| SAPI & SASI | SAPI: Smartphone Assisted Personal Interviewing. With this method, the data is entered into a smartphone by the interviewer. SASI: Smartphone Assisted Self Interviewing. With this method, the data is entered into a smartphone by the respondent. |

Competitor benchmarking

It is very important that companies compare themselves to their competitors because ... that’s what clients do all the time, and the way they choose! What you have to do is 1) to identify your main competitors IN THE MARKET SEGMENT concerning your business and marketing plan 2) if there are too many, choose a few competitors who, because of their characteristics, mostly resemble the type which you feel are more dangerous. 3) Write a list of the features you want to examine. What do you have to compare? All characteristics that enter the competitive game in this specific case. Let’s see a few of them. And how can you get information? By observing, visiting stores, talking with clients ...

| Positioning | What is your competitors positioning in customers’ minds? Do they regard his product as high – end, medium level, discount level? And what is your positioning in comparison? |

| Benefit for consumers | Is your competitor’s product more or less effective and/or efficient in responding to customers’ needs? |

| Service |

What is his level of service? Pre and post-sale assistance? Delivery? Organisation? Administration? And yours? |

| Promotion |

Does your competitor promote his product adequately? How much do you estimate that he invests in communication? Which media does he choose? Is he communicating on social networks properly? How is his website? Is it nice, easy to navigate, updated, rich? What is the unique selling point he uses? How high is is brand awareness (which means that consumers recognize his brand and can say which values it is linked to)? And his reputation (is he «well known» because of ethics, quality, traceability, environment friendliness)? And what about you? |

| Competitive analysis | How does your competitor face competition? Has he achieved competitive advantages? Has he developed a bargaining power vis a vis suppliers? Have his clients become so loyal to his brand that it would be expensive – in terms of promotion and innovation – to make them change their mind? Is it difficult, for another company, to sell a similar product and attract clients just saying «me too»? Are high investments needed to enter the market segment where he is incumbent? |

| Price | What is your competitor’s price strategy? Is he a price taker or a price maker? Is he able to obtain a price premium, because of his perceived quality? How is his price compared to yours? Higher? Lower? Why? Do you think the difference is justified? |

| Cost structure | Are you able to find information about your competitor’s cost structure, to be compared with yours? Is his financial statement available? By comparing costs, you might discover that there are ways to reduce the incidence of particular costs ... |

| Performance | If the finance statement is available, you might compare margins and profits, and if it refers to different years, you can also compare trends ... |

SWOT analysis tool

Strengths

Weaknesses

Opportunities

Threats