Introduction

Five Reasons You Need a Business Plan by Alan Gleeson

When I am asked to explain why business planning is so important, my first inclination is to quote Lewis Carroll. In Alice’s Adventures in Wonderland, Alice comes to a fork in the road and asks:

“Would you tell me, please, which way I ought to go from here?”

“That depends a good deal on where you want to get to,” said the Cat.

“I don’t much care where–” said Alice.

“Then it doesn’t matter which way you go,” said the Cat

The Marketing Plan for Exports

As usual, we put the accent on planning. As far as exporting is concerned, planning, monitoring, checking and fine tuning becomes even more important, since, unless you already possess a country specific know-how, or are in the condition of relying on very expert advisors, you are facing a higher degree of uncertainty.

When writing a document, we always have to ask ourselves whom it is addressed to. It may be:

- a bank or another private or public subject you would like to persuade to invest money in the project;

- a business partner you already have, and whom you would like to involve in the new idea to start selling abroad;

- a potential client;

- a potential provider;

- your staff;

- yourself, to get a clearer vision of the project

- ...

A marketing plan for exports is often divided into 4 sections:

Optional, for a more complete business plan

Financial analysis

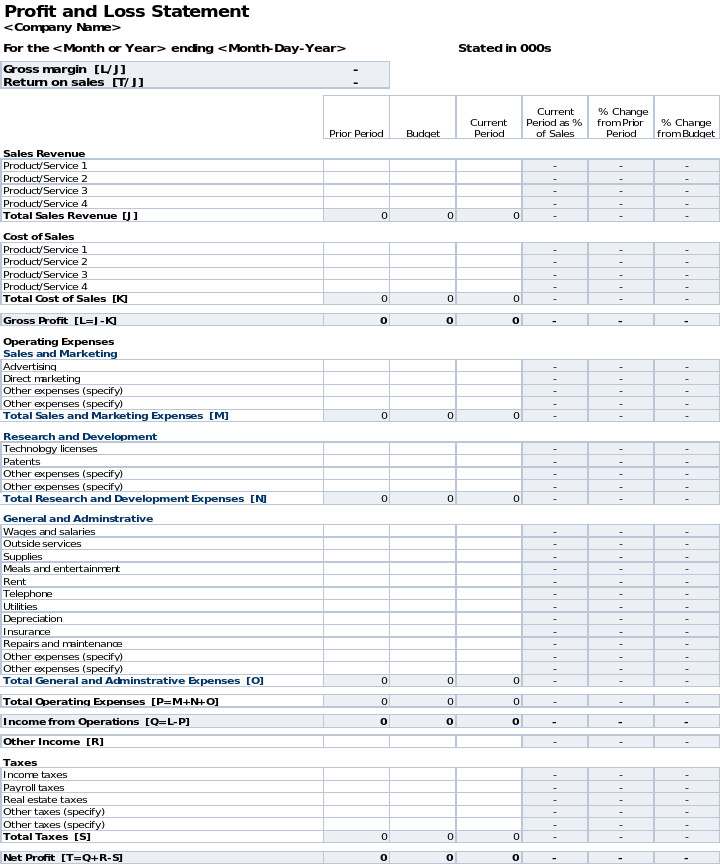

In the financial analysis you have to:

-

Try and forecast your possible sales (3 years), according to market dimension and trends, and your offered volumes

-

Calculate the cost of the goods you sell, which helps you in your pricing policy

-

Evaluate your cash flow, in the projected horizon of 3 years (calculated monthly), which comes from the relative timing of expenses and income

-

Elaborate a break-even analysis

-

Prepare a projected profit and loss statement (income statement)

Here are a few instructions

-

Forecasting your sales (it is better to be realistic, that is not too optimistic, it has to be a possible result, and has to be sufficient to make a profit. It is better to forecast units sold and prices separately. The forecast should cover 3 years.

The table should contain the 3 years, volumes and unit prices in each year, and the total given by volume per unit prices. In this link you can find indications about sales forecasting methods for small business.

-

Calculate the costs of the goods you sell

You can multiply the units you plan to sell by the sum of unit costs of: Raw Materials, Labour, Direct Utilities, Packaging, Labeling, Freight, Insurance, Tariffs, Other Expenses -

Prepare a cash flow projection.

Here, you start with the cash you have available at the beginning of the period, then you have to try and forecast, each month, what your revenues will amount to (paid invoices, other sources of income). Here, we are not speaking of issued invoices, but of paid ones. This is the cash inflow.The same goes for expenses (cash outflow). Expenses can be payments to suppliers (not just received invoices, but effective cash disbursement), payments to workers, or commissions to sales representatives, payments of taxes, payments for utilities (such as the electricity bill); shipping costs, expenses for marketing or advertising (the moment you pay the advertising agency), debts and interests paid, etc..

Then you have to compare the outflow with the inflow, in each period, to see if the balance is positive (it has to be, or you would not have any cash left).

Here is a useful explicatory link: -

For the break-even analysis, you can go to chapter xx of this course.

-

The projected profit and loss statement is not so difficult as it may seem, once you have gathered the necessary information. Here you find a Microsoft Office template, which you can download from this link. As you can see, you are progressively subtracting from your sales revenue different kinds of costs, thus obtaining a gross and then net profit. You can also ask your accounting consultant to do that for you.

Profit and loss statement

Links

Exercise

Try and build a marketing plan for the following exports.

- High quality red wine, target market: Japan

- Wagyu meat: target market: Italy

- Dried healthy berries (such as Cranberries, Golden Berries, Goji Berries): target market: Sweden

This communication (website) reflects the views only of the author, and the Commission cannot be held responsible for any use which may be made of the information contained therein.